If you are ready to upgrade your vehicle and are lost in a sea of price options from dealerships, you may be considering the benefits of leasing vs. buying a car. Here is what you need to know before making that decision.

Buying

Leasing

Which Is Best?

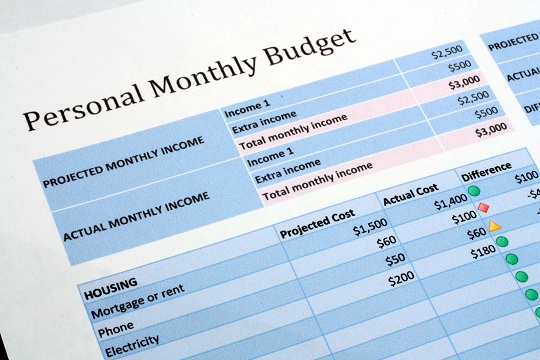

Ultimately, you must consider which option is best for you and what fits your personal budget. Are you more concerned with owning a vehicle for a long period and possibly becoming debt-free for a while? Or, are you more interested in updating your vehicle every two or three years to keep up with technology and safety upgrades?

Risk of major repairs required for your vehicle should also be considered when analyzing leasing vs. buying a car. These will often not be needed until after the two- or three-year period and are another expense to consider. Additionally, it is a good idea to consider how much the vehicle will really depreciate in that time period. A vehicle is worth only what someone is willing to pay. It’s important to research depreciation rates to see if the amount you will pay in a lease is truly the depreciation value or if you are better off buying the vehicle and selling it yourself in two years.

Find Someone To Crunch The Numbers

If you are still unsure, it might be best to talk to a professional accountant about which option is best for your particular situation. TalkLocal can get you in touch with a professional in your area quickly, easily, and best of all, for free!