Written by Dallea Caldwell

Time is money. Through exercise and healthy choices, you can make an investment of your time and watch it accrue interest, adding years to your life. With friends and family, you can spend time and gain something more valuable in return. And time, like money, can be wasted quicker than MC Hammer’s royalty payments.

The average American is online about 13 hours per week. That’s after the ol’ 9-to-5, the mind-numbing commute, and scrambling to pull a meal together. That’s almost 2 extra hours with us not being fully present with our children, friends, and family. Is that time invested, well-spent, or just wasted?

Here are some smart, money-saving online tools that save time and money- turning your web-browser into your command center for success.

Moneycrashers.com: The finance and lifestyle guidance blog lets you surf the web while staying on top of the tumultuous economic waves. Find out what’s new in money-saving and business development strategies, and explore under-appreciated takes on budget issues like the importance of financial role-modeling for your children.

GasBuddy: For once and for all, the executive branch has little-to-no control over the per barrel gas-prices. So quit voting with your gas tank and start comparison shopping. GasBuddy lets you compare has prices at stations near you, which can vary as much as 10%-20% from block to block.

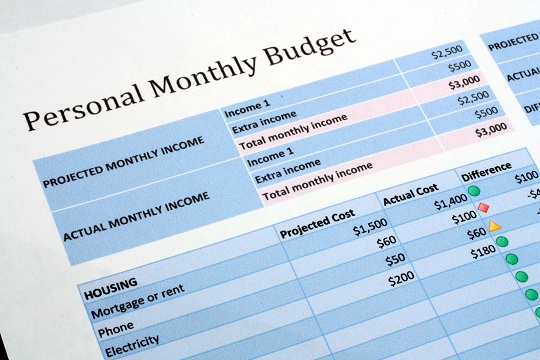

Mint: Our least favorite friend Bill visits multiple times monthly and is never late. So, when he pays you a visit you didn’t prepare for… it’s you who pays most dearly. Mint is a free financial management service where you can track and classify your assets and expenses all in one place. It even notifies you when Bill comes a-knocking.

FreeCycle: Love free useful stuff, but feel weird trying to get it from your great aunt’s will? Then Freecyle is a great resource for shopping other people’s trash to get free treasures to call your own. Sure beats retail therapy, or trying to make up for three decades of completely ignoring older well-to-do relatives.

Bankrate: There’s nothing wrong with being a little (or a lot) calculating when it comes to making financial decisions like choosing the best credit card company/mortgage lender/etc. for you. Bankrate lets consumers review and rate financial service providers. It’s also equipped with a number of useful calculators for car loans, mortgages, and amortization/repayment schedules.

TalkLocal: We’d frankly be remiss if we didn’t mention that with zero required online research on your part, you can comparison shop between three top-rated service providers that match your schedule, location, and job needs. Our algorithm ensures that the cheapest will still be one of the best pros for you. Just enter your service needs and stand by for a phone call through a secure line. So, after only a couple of highly productive minutes, you’re already free to play BeJeweled or something.

No More Wasting Time on the Internet

If you’ve ever even heard of the internet (and you obviously have), then you know that knowledge isn’t necessarily power anymore. Like if, for example, your idea of being informed is knowing what flower girl dress Kim and Kanye bought for North. So, if your web-use primarily consists of Puppy Learns to Howl extended remix edition, then please stop — Hammer Time has run out.