People across the world start the New Year by setting goals they hope to achieve. A great way to improve is by planning your budget and finances for the upcoming year.

In planning and tracking your money, you can protect yourself from extraneous spending. By scaling back on purchases that may not prove to be beneficial, money can be saved for other important things. Here are a three powerful steps that you can take on as financial resolutions this year.

Separate Savings Accounts

When creating a budget, identify which assets will be saved for different situations. By allocating funds to a set number of accounts, you will be less likely to use that money for extraneous spending. Some great examples to begin saving for are retirement, college, and emergency funds. Continue to add and monitor each account so that you will be well-equipped for the future.

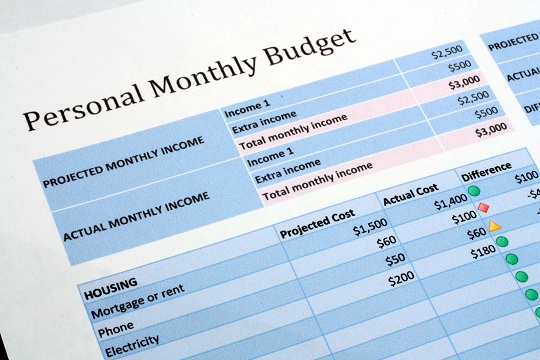

Track Your Spending

One of the best ways to cut extraneous spending is to keep track of what you do on a daily basis. Mark down your food, gas, clothes, and other expenditures. By writing and analyzing spending patterns, you can better determine what is beneficial and what is wasteful.

Examine Future Expenses

Sit down and look ahead at where your money will have to go this year. Categorize your fixed expenses, such as the mortgage, vehicle payments, and other bills. By assessing what you will have to spend money on in the future, you can plan better on how to use it today.

Assess Your Financial Goals

If you’re having trouble in planning and meeting your goals, contact a financial adviser. To find the one that is right for you, use TalkLocal. We will connect you with the most reputable financial advisers in your area who can help you get the most out of your money. TalkLocal will help you find the right professional who can provide the guidance you desire.